File:Taxincentivescorporate.jpg

Revision as of 14:10, 3 June 2013 by Drlesmgolden (talk | contribs) (If a single corporation provides the entire loan, its loan-investment of $2.9 million results in a $2.9 million federal deduction. The total return then depends on the federal tax bracket of the corporation.)

Taxincentivescorporate.jpg (651 × 344 pixels, file size: 69 KB, MIME type: image/jpeg)

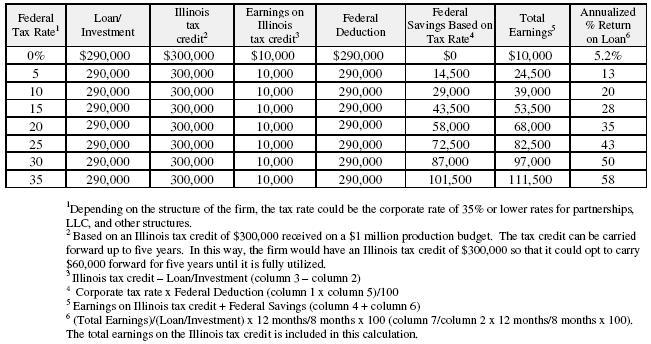

If a single corporation provides the entire loan, its loan-investment of $2.9 million results in a $2.9 million federal deduction. The total return then depends on the federal tax bracket of the corporation.

File history

Click on a date/time to view the file as it appeared at that time.

| Date/Time | Thumbnail | Dimensions | User | Comment | |

|---|---|---|---|---|---|

| current | 20:48, 14 June 2013 |  | 651 × 344 (69 KB) | Drlesmgolden (talk | contribs) | try agian 1 mill |

| 14:29, 14 June 2013 |  | 651 × 344 (69 KB) | Drlesmgolden (talk | contribs) | one million | |

| 23:14, 3 June 2013 |  | 650 × 344 (70 KB) | Drlesmgolden (talk | contribs) | ||

| 16:06, 3 June 2013 |  | 727 × 402 (91 KB) | Drlesmgolden (talk | contribs) | ||

| 14:10, 3 June 2013 |  | 727 × 339 (74 KB) | Drlesmgolden (talk | contribs) | If a single corporation provides the entire loan, its loan-investment of $2.9 million results in a $2.9 million federal deduction. The total return then depends on the federal tax bracket of the corporation. |

You cannot overwrite this file.

File usage

There are no pages that use this file.